Winbacks fail by default

💔 Churned subscribers behave more like new prospects Than Loyal Customers, Media buyer index of the week, and more!

Howdy readers 🥰

In this newsletter, you’ll find:

💔 Winbacks fail by default

📊 Costs climbed fast, but winners still emerged

🏆 Ad of the Day

If you’re new to ScaleUP, then a hearty welcome! You and 50k+ CEOs, CMOS, and marketers have reached the right place. Let’s get into it, shall we? Oh! Before you forget, if someone forwarded this newsletter to you, don't forget to subscribe to our newsletter so you never miss out!

Together with Insense

HACK: Get 20+ ad variations (per creator) to scale your Q1 ads effortlessly

This is the quarter where brands start strong, then performance quietly slips as last quarter’s winners fatigue and CPMs rise again. Doing nothing means wasting January and February spend on creatives that’re already tapped out

This is exactly where Insense saves you. You get fast, affordable UGC at the volume Q1 demands without blowing up your team’s bandwidth.

- 20+ raw assets from each creator you can spin into dozens of variations.

- 14-day turnaround so you never fall behind rising CPMs.

- Lifetime usage rights, so every winning cut keeps earning for months.

- Cost-efficient sourcing that lets you test aggressively

Over 2,000+ brands like Quip, Revolut, and Matys use Insense for one reason: it keeps creative supply high when everything else slows down.

Imagine finishing Q1 with a full folder of fresh ads ready to deploy instead of praying old winners magically revive.

Book a free strategy call by Jan 30th and get $200 for your first campaign.

💔Winbacks fail by default

The biggest mistake brands make with churned subscribers is assuming they’re still in a relationship.

They’re not.

Once someone cancels a subscription, the mental contract resets. They stop thinking like a customer who needs reassurance and start behaving like someone evaluating options again. That’s why so many winback flows fail. They speak to loyalty when the buyer is back in comparison mode.

This is where most retention messaging breaks.

“We miss you.”

“Come back for 15% off.”

“Your benefits are waiting.”

Those messages assume emotional attachment. Churn usually means the opposite. The product didn’t feel necessary right now, or something shinier showed up. That’s not resentment. It’s indifference.

The mechanism that works instead is re-prospecting.

When churned subscribers see the same retention creative they ignored in email, it reinforces their exit decision. But when they’re shown new top-of-funnel ads they’ve never seen, the brand re-enters their world as an option, not a nag. The context changes from “convince me again” to “oh, that’s interesting.”

This is why winback campaigns built on fresh prospecting creative often outperform discount-heavy reminders.

A founder might assume discounts are the lever. In practice, discounts only close when interest already exists. New angles recreate interest. Offers just finalize it.

There’s a constraint here worth respecting. Not every churned customer should be recovered immediately. Some need time for relevance to return. That’s why excluding recent purchasers and recent churn windows matters. Timing determines whether the ad feels helpful or intrusive.

Meta works in this scenario because it doesn’t rely on memory. It relies on behavior. If a churned customer engages with a new creative angle, the system treats them like any other high-intent user, not a lapsed account. That’s a structural advantage email doesn’t have once attention drops.

The practical takeaway is simple but uncomfortable.

Stop treating churn as a retention failure that needs explaining. Start treating it as a reset state that needs re-framing.

If the product is still right, the story needs to change. If the story lands, the offer can follow. When brands get this sequence right, winbacks stop feeling like recovery efforts and start behaving like efficient acquisition with a familiarity edge.

Churn doesn’t mean the door closed.

It usually just means the conversation ended.

The fastest way back in isn’t nostalgia. It’s relevance.

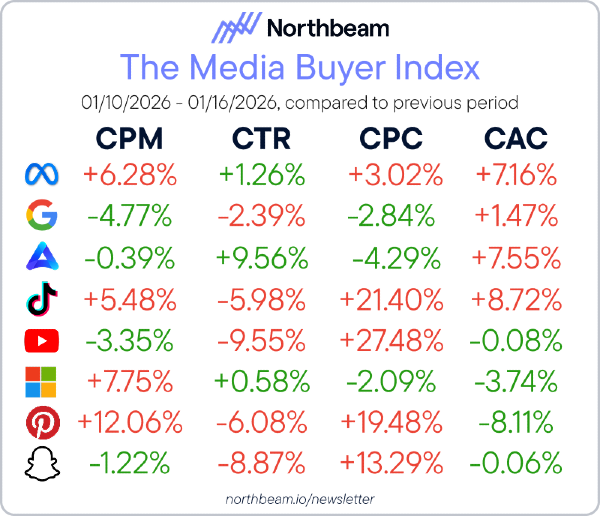

📊 Costs climbed fast, but winners still emerged

Paid media moved into a more volatile pocket this week. Buying got less forgiving, and efficiency gaps widened between channels. Teams that treat budgets as flexible, not fixed, will protect margin and keep scale open.

The Breakdown:

1. CPC - Costs rose on Meta, TikTok, YouTube, Pinterest, and Snapchat. Costs fell on Google, Amazon, and Microsoft. Expect higher creative pressure and more aggressive pruning where costs climbed, while lower-cost channels become your testing lane for new angles.

2. CAC - CAC rose on Meta, Google, Amazon, and TikTok. CAC fell on YouTube, Microsoft, Pinterest, and Snapchat. Push harder on landing page speed, offer clarity, and checkout friction in the rising CAC group, and use the falling CAC group to rebuild volume safely.

3. ROAS - TikTok led with +6.85% ROAS, with Pinterest up +6.69% and Microsoft up +1.71%. Meta, Google, Amazon, YouTube, and Snapchat declined, with Snapchat down -23.61%. Scale should follow improving return pockets, not the loudest reach.

Spend stayed concentrated, with the largest channel still holding 64.53% budget share despite a small pullback. Budgets rotated into the next biggest channel at 25.85% share, while smaller pockets gained share. Keep reallocating weekly, and scale only where ROAS stays resilient.

Together with The Shift

The Only AI Newsletter Built for Output

Most AI newsletters flood you with tools, headlines, and hype. The Shift does the opposite.

Every issue cuts through the noise to show you what actually works, with real-world breakdowns of workflows, systems, and strategies that use AI to get real results, not just automate busywork.

Plus, get instant access to 3,000+ top tools, vetted prompts, and free courses so you can apply, not just absorb.

If you want less noise and more wins, you belong here.

🎥 Ad of the Day

What Works:

The Angle They’re Using - This is “skincare as a subscription deal,” not “skincare as a miracle.” It makes Curology feel like the easiest way to be consistent, not the fanciest product.

The Real Conversion Move - “Starting at only $1/day” reframes price into something painless. It turns a monthly spend into a daily habit cost, which makes the decision feel smaller.

How It Reduces Decision Stress - “Complete skincare” does a lot of work. It tells the buyer they don’t need to build a routine, compare products, or guess what goes together.

If your product replaces multiple decisions, sell the bundle feeling. People pay for “done for me” more than they pay for “best ingredients.”

Advertise with Us

Wanna put out your message in front of over 50,000 best marketers and decision makers?

We are concerned about everything DTC and its winning strategies. If you liked what you read, why not join the 50k+ marketers from 13k+ DTC brands who have already subscribed? Just follow this.

At ScaleUP, we care about our readers and want to provide the best possible experience. That's why we always look for ways to improve our content and connect with our audience. If you'd like to stay in touch, be sure to follow us EVERYWHERE🥰

Thanks for your support :) We'll be back again with more such content 🥳